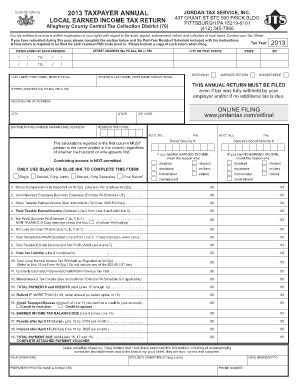

Get a copy of your tax record to view your tax account transactions or line-by-line tax return information for a specific tax year. Get help choosing a tax professional to file your taxes. Request Online What You Need. ST-in triplicate (3copies).

However, it is advisable that assessee should have copies, one copy will be returned back as an acknowledgement to the assessee by the Central Excise Officer. May not be combined with other offers. To qualify, tax return must be paid for and filed during this period. Easily file federal and state income tax returns with 1 accuracy to get your maximum tax refund guaranteed.

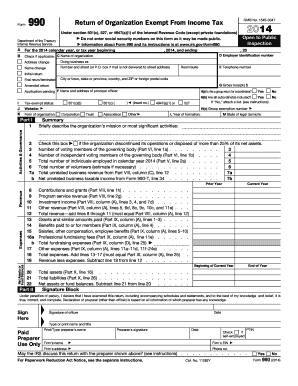

US Individual Income Tax Return Annual income tax return filed by citizens or residents of the United States. Send your tax return by the deadline. If you did not send an online return last year, allow extra time (up to working days) as you’ll need to register first.

There are different ways to. The first half year return will be filed on or before th Oct and the second half year return will be filed on or before th April. To understand the process you need to have idea of service tax calculations. Service tax return is filed for every half year. A lot of complicated details are required to be furnished in the service tax return and therefore most people prefer to file the service tax returns through a professional itself.

Transparent Pricing Pricing with no surprises, and you get what you pay for. Login to your MyTurboTax account to start, continue, or amend a tax return , get a copy of a past tax return , or check the e-file and tax refund status. This app works best with JavaScript enabled. International Fuel Tax Agreement (IFTA) Timber Yield Tax. California Fuel Trip Permit.

Prepaid Mobile Telephony Services Surcharge. Lodging online with myTax is the quick, easy, safe and secure way for you to prepare and lodge your own tax return. The deadline to lodge your tax return is October.

Benefits of lodging with myTax. This portal has all the tools for filing tax returns and related information. My compliments to IT Team for constantly upgrading it. I am happy that many more salaried tax payers like me can file their returns online with honesty and transparency and without fear of human discrimination. One of the most convenient aspects of filing a tax return online is that you can pay with a debit or credit car or take the funds directly from your bank account.

Direct deduction and deposit is typically the fastest way to undergo the process, while also reducing the risk of identity theft and processing errors. TaxSlayer offers tax software and products to prepare and e-file your tax return online. Simply Free Single, married filing joint, and students can file for $(simple returns ). Efile your tax return directly to the IRS. Prepare federal and state income taxes online.

About this video steps of e- filing of service tax return in India. It is very simple but need to understand the full system. This video is specially for Indian Accountants and students so ,. Maximum refund and $100k accuracy guarantee. Once you’ve registere you can send your tax return online, or use commercial software or paper forms. Start filing your taxes for free today!

You then have to pay your bill by the deadline. Tax returns cover the financial year from July to June and are due by October. You can get help filling in your return.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.